The Premier Payroll Outsource Company for Small Businesses

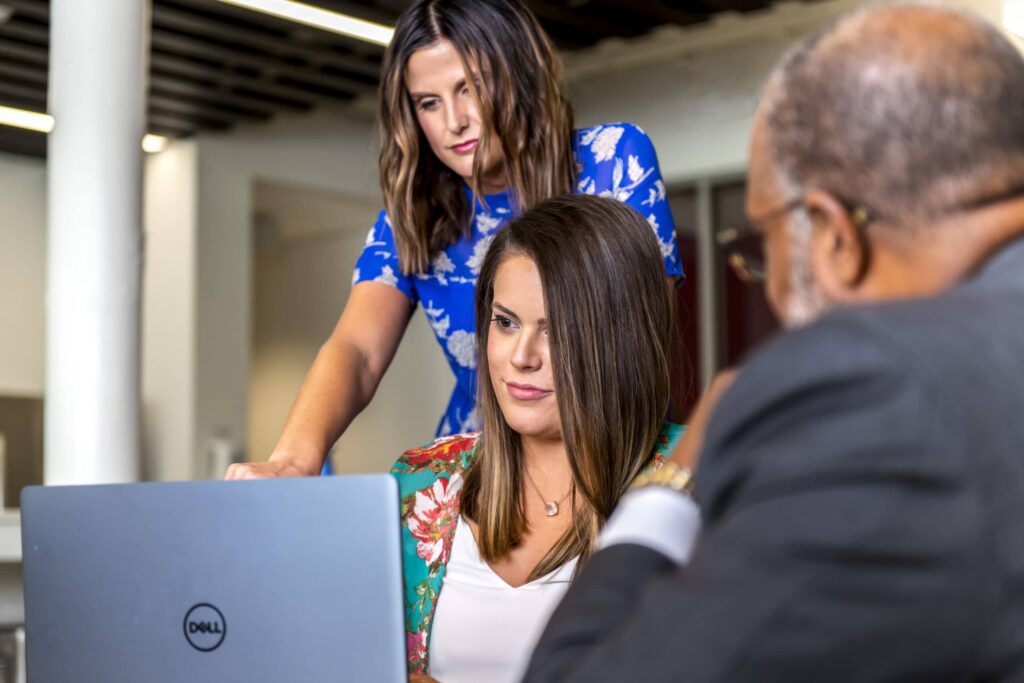

Managing payroll functions and payroll taxes can be an overwhelming burden, diverting valuable time away from your core business objectives.

Axcet HR Solutions, a certified PEO, is a leading provider of PEO payroll services and a top payroll outsourcing company for small businesses. We offer strategic solutions to the multifaceted challenges of mayroll management and ensuring compliance with federal, state and local tax laws.

PEO Services Help Small Companies Thrive

Our Approach to PEO Payroll Service Administration

Growing Your Business: Is a PEO the Right Choice for Your Small to Medium Enterprise?

By outsourcing tedious HR tasks like payroll processing, benefits, risk management and human resources to a PEO provider, smaller businesses can free up valuable time and experience many more great benefits.

PEO Payroll Services

- Payroll Services

- Dedicated payroll administrator to answer employee questions

- Online payroll entry and approval

- Online employee portal »

- Online onboarding for employees

- Child support, garnishment and wage assignment administration

- General ledger payroll interface

- API integration to QuickBooks Online and Xero (additional cost)

- Job costing and labor distribution

- Access to online reports and report builder

- Paid time off (vacation, sick, personal) maintenance and management options

- Professionally printed paychecks & vouchers

- Earned wage access (on-demand pay)

- Direct deposit into multiple accounts

- Paycard option

- Reconciliation of payroll checks

- Customized payroll delivery options

- Paydate notifications via email or text

- Certified payroll processing and reports

- Preparation and distribution of W-2 forms with online option

- Preparation and distribution of 1095-Cs as required

- Responses to employment & wage verification requests

- Time and attendance interface capabilities

- Integrated time and attendance solution (additional cost)

- Assistance with implementation of payroll best practices

- Tax Administration

- File 940 and 941 forms

- File state withholding tax returns

- File state unemployment tax returns

- Deposit federal and state withholding tax liabilities

- Deposit federal and state unemployment taxes

- Deposit other state and local tax obligations

- Transmit W-3 to Social Security Administration

- Payroll Compliance

- Guidance on legally compliant pay practices

- Compliance assistance with FLSA

- New hire reporting administration and liability

- Employee file maintenance

- Assistance with audits

Our team stays up to date on changing regulations and keeps you in the loop, including labor laws and tax compliance obligations.

Rave Reviews. Real Results.

Navigating Payroll and Tax Administration with Ease

Discover how outsourcing your payroll and tax administration to certified* pros can transform your business operations. Here are some commonly asked questions by those interested in leveraging PEO payroll services.

Payroll services are a business solution that ensures your employees receive the pay they have earned. If your business has W-2 employees, then the IRS requires you to pay them through a payroll system so it can confirm your company and your workers are paying taxes. When your employees are paid accurately and on time, they feel valued you have one less thing to worry about.

Almost all small businesses can benefit from using a payroll service provider that is certified* by the IRS, like Axcet. Yes, it can feel scary to outsource. The truth, though, is that continuing hands-on management of payroll processing, especially as your employee headcount increases, can take your attention away from growing your business.

With Axcet, you’ll have a trusted, reliable, knowledgeable outsourced payroll provider who has your back every step of the way.

Clients who utilize Axcet’s services provide employee hours or salary amounts and approve their payroll online. That’s it. Axcet handles every other step to getting payroll out the door quickly and correctly.

What are the advantages of using a payroll outsourcing company?

Choosing Axcet as your PEO payroll service provider extends beyond payroll processing. We offer comprehensive support, including employee time and attendance management, location tracking for payroll and taxes, and meticulous payroll tax administration.

As a certified PEO, Axcet is solely liable for federal employment taxes on wages paid to clients’ employees, safeguarding your business against penalties.

Outsourcing to a PEO payroll services provider allows you more time to focus on managing your core business. When you work with Axcet, you can count on your payroll and state and federal taxes to be done correctly, on time and to your specifications. Our team of experienced, certified payroll administrators will take this worry off your desk.

A payroll outsourcing company like Axcet will process your payroll by gathering your employees’ information (hire date, job title and pay rate), obtaining any timecard data, calculating the pay due to each employee and then paying that amount by issuing a direct deposit or payroll check. Pay can also be issued through a reloadable debit card (pay card) for employees who don’t have bank accounts.

Outsourcing payroll to Axcet, a certified PEO and one of the best payroll companies for small businesses, ensures that payroll will be calculated correctly and employees will be paid on time, every time.

Axcet can manage your ongoing payroll as well as start-to-finish payroll basics, from new-hire forms to year-end tax documentation such as W-2s. All you have to do is provide the data and approve your payroll online.

Besides time saved, you never have to worry about legal compliance. Your PEO payroll service team stays up to date on changing regulations and keeps you in the loop.

Yes, one of the most common reasons to outsource payroll (after saving time and resources) is to ensure taxes are submitted in compliance with the law. As a certified payroll outsourcing company, Axcet will handle all state and federal tax contributions compliantly, accurately and on time. Axcet will also distribute end-of-the-year W-2 forms to your employees. See more information about tax administration.

No, Axcet HR Solutions provides payroll solutions as part of our comprehensive HR offerings. As a full-service PEO (professional employer organization), we integrate individual services like workers' comp, payroll, benefits and compliance under one complete HR solution, helping businesses streamline their HR functions efficiently and effectively.

*All services are part of Axcet’s full-service HR solutions as a certified PEO, designed to support your business comprehensively.

Payroll Expertise and Resources »

You won't want to miss these articles and white papers from your experts on payroll and tax administration.